DIVORCE

We protect your interests at all stages of your divorce proceeding.

The Law Office of Steven M. Bishop, CFLS, in San Diego, takes a very straightforward approach to family law.

At our firm, we believe it is our goal to put you in the best possible position to achieve success in your case, so your family can deal with these problems effectively and efficiently.

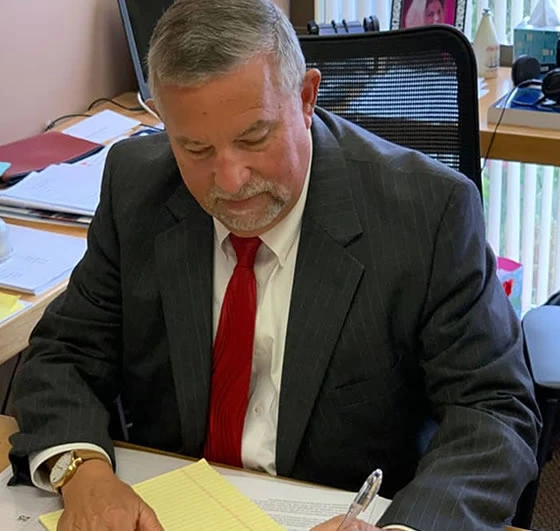

Our attorney, Steven M. Bishop, is a specialist in family law, as certified by the California Board of Legal Specialization. For over four decades Mr. Bishop has been helping the people of San Diego and surrounding Southern California counties with their family law problems.

MORE ABOUT OUR FIRM

ACHIEVEMENT

Certified Family Law Specialist, California Board of Legal Specialization

Attorney Steven M. Bishop has been practicing family law in San Diego, California for over four decades.

During the entirety of that time, his emphasis has been on providing his clients and the legal community with the highest standard of care and professionalism. Steven M. Bishop has a work ethic second-to-none.

Mr. Bishop is a San Diego native, graduating from Helix High School in 1970 and then from San Diego State University earning a Bachelor of Arts degree in an accelerated three-year program in 1973. Following graduation, Steven pursued his childhood dream of becoming a lawyer and advocating for his clients.

LEARN MORE ABOUT MEFirm founder attorney Steven M. Bishop is a certified specialist in Family Law by the California Board of Legal Specialization. Only an attorney who is board-certified can call himself an expert in a particular area of law. This is your assurance that your divorce, child custody dispute or other family law concern will be handled by an attorney who meets the highest qualifications for experience and knowledge of California law.

For more than four decades, attorney Steven M. Bishop, has helped clients find solutions to the most difficult family law matters. Whatever legal issues you are facing, we are here to offer you personalized guidance and understanding.

Each family law case requires a careful analysis to determine the best possible approach. When you work with our firm you will sit down with Mr. Bishop and be able to tell him your story. He will listen to what is happening with you and help you make the decisions right for your future.

Mr. Bishop and his dedicated staff of trained professionals will work tirelessly to resolve your case as efficiently as possible. He will attempt to negotiate a solution which helps reduce the stress and uncertainty you may be experiencing, and help you move on with your life. Should negotiations fail to be productive, Mr. Bishop is an aggressive litigator. You will not need to find a new lawyer if your case ends up going to trial. Mr. Bishop will be there for you through each stage of your case.